From Scrolling to Schooling: Mengoptimalkan Ekosistem Media Sosial Indonesia untuk Akselerasi SDGs dalam Pendidikan

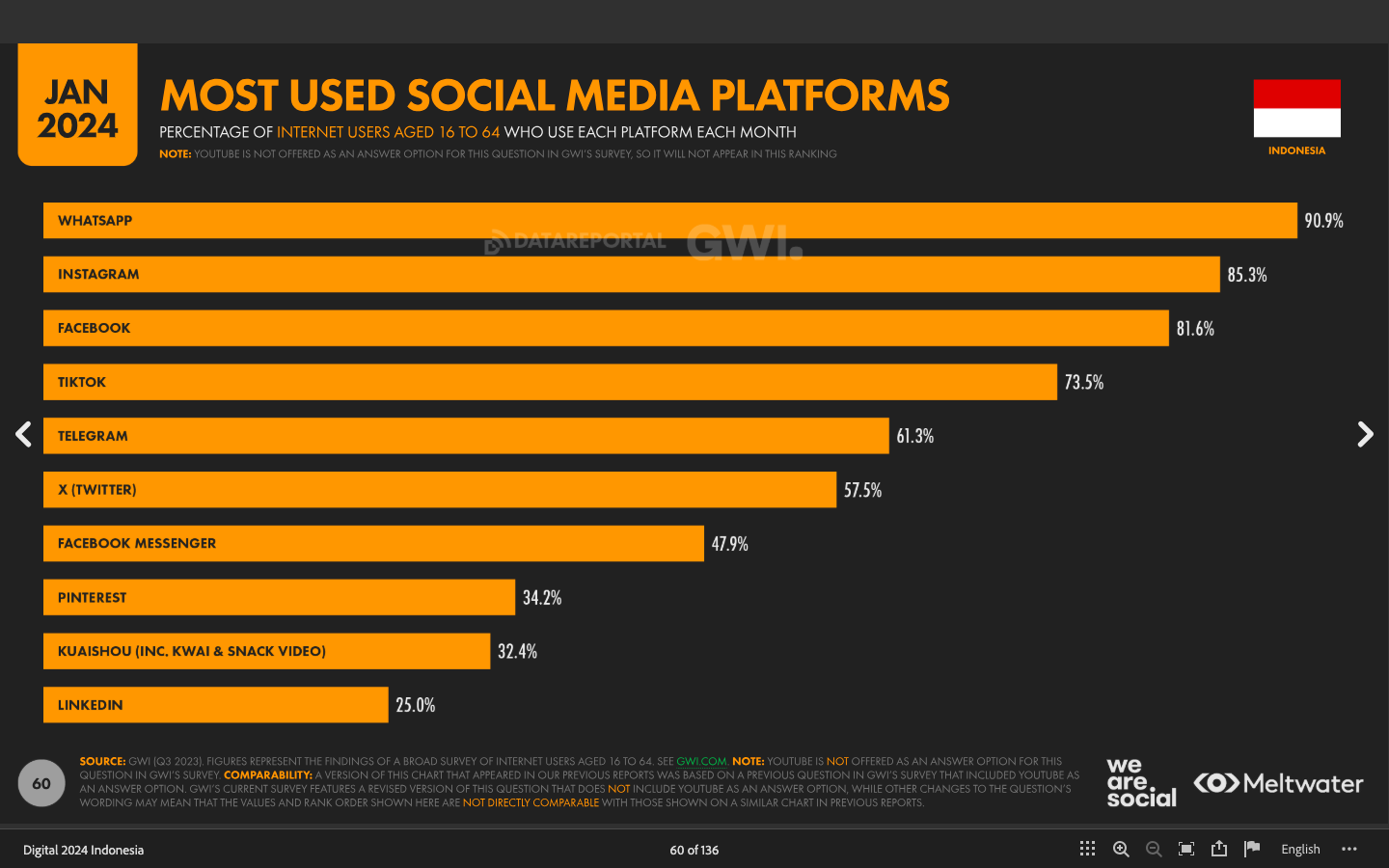

Indonesia telah mengukuhkan dirinya sebagai salah satu negara dengan tingkat adopsi media sosial tertinggi di dunia. Berdasarkan pemahaman saya, fenomena ini bukan sekadar tren sementara, melainkan transformasi fundamental dalam cara masyarakat kita berkomunikasi, mendapatkan informasi, dan bahkan belajar. Data terkini menunjukkan dinamika penggunaan yang mengagumkan—dengan WhatsApp mencapai penetrasi 90,9% di kalangan pengguna internet usia 16-64 tahun, diikuti Instagram (85,3%), dan Facebook (81,6%). TikTok, yang relatif baru, telah mencapai angka 73,5%, menunjukkan adopsi yang luar biasa cepat.

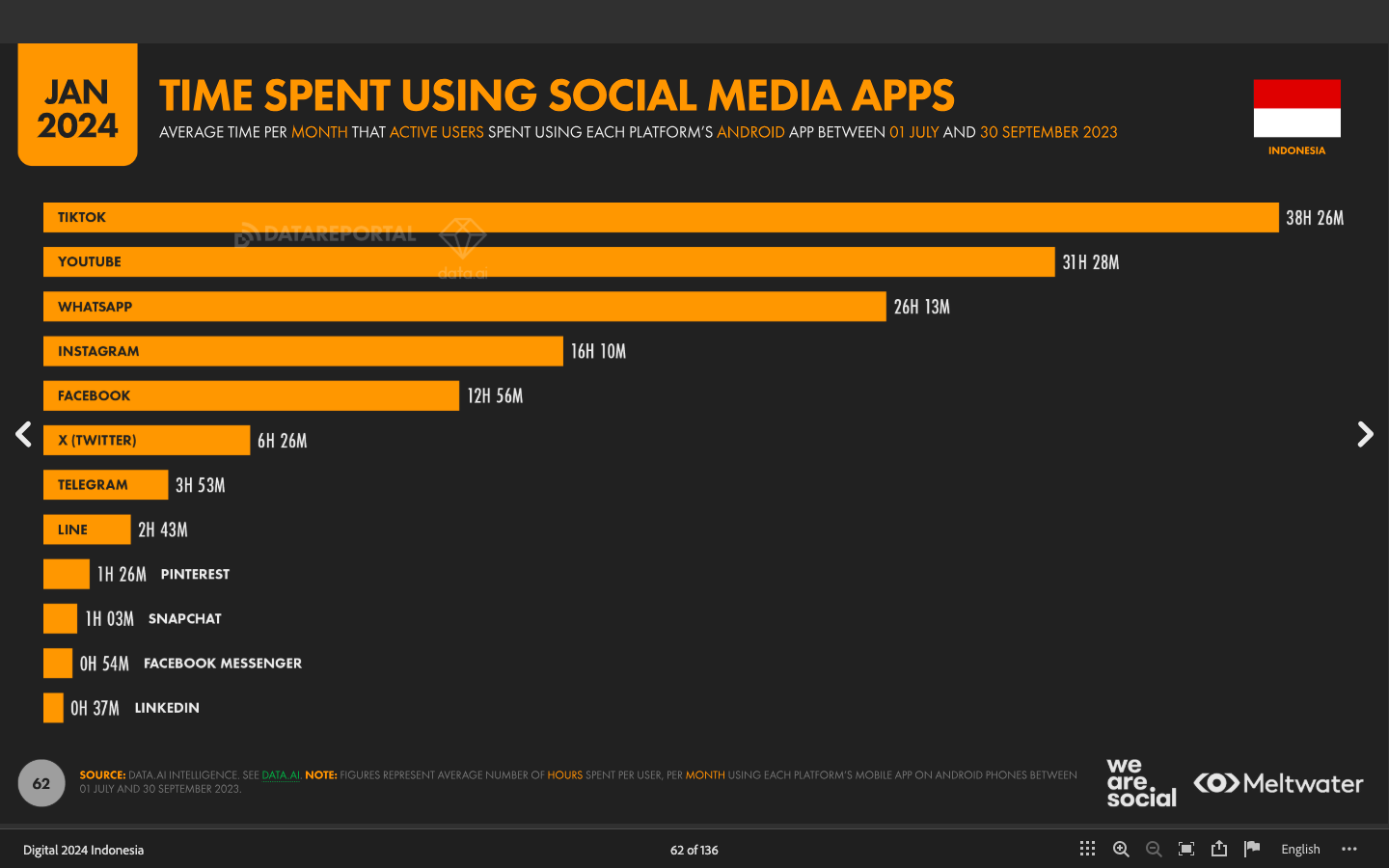

Ketika kita membahas Sustainable Development Goals (SDGs), khususnya SDG 4 tentang Pendidikan Berkualitas, data tersebut menawarkan perspektif berharga. Seperti pepatah “sambil menyelam minum air”, masyarakat Indonesia berpotensi mendapatkan manfaat edukatif sembari menggunakan media sosial untuk tujuan primer lainnya. Pertanyaannya, bagaimana kita dapat mengalihkan sebagian dari 38 jam 26 menit yang dihabiskan rata-rata pengguna TikTok setiap bulannya menjadi aktivitas yang mendukung capaian pendidikan nasional?

Lanskap Digital Indonesia: Pola Konsumsi yang Mengejutkan

Menelaah data penggunaan media sosial di Indonesia mengungkap preferensi yang menarik. Meskipun WhatsApp merupakan platform yang paling banyak digunakan (90,9%), TikTok justru mendominasi dari segi durasi penggunaan dengan rata-rata 38 jam 26 menit per bulan per pengguna. YouTube mengikuti dengan 31 jam 28 menit, sementara WhatsApp mencatat 26 jam 13 menit.

Fenomena ini mencerminkan pergeseran preferensi konsumsi konten—dari teks menuju visual dan audio-visual. Dalam konteks pendidikan, hal ini berimplikasi penting pada bagaimana materi pembelajaran sebaiknya dikemas. Dari pengalaman yang relevan, materi pendidikan yang disampaikan dalam format video pendek atau interaktif cenderung mendapatkan engagement lebih tinggi dibandingkan format tradisional.

“Tak kenal maka tak sayang,” kata pepatah lama. Untuk mengoptimalkan media sosial bagi pendidikan, pemahaman mendalam tentang pola penggunaan ini menjadi prasyarat mutlak.

Motivasi di Balik Layar: Apa yang Dicari Masyarakat Indonesia?

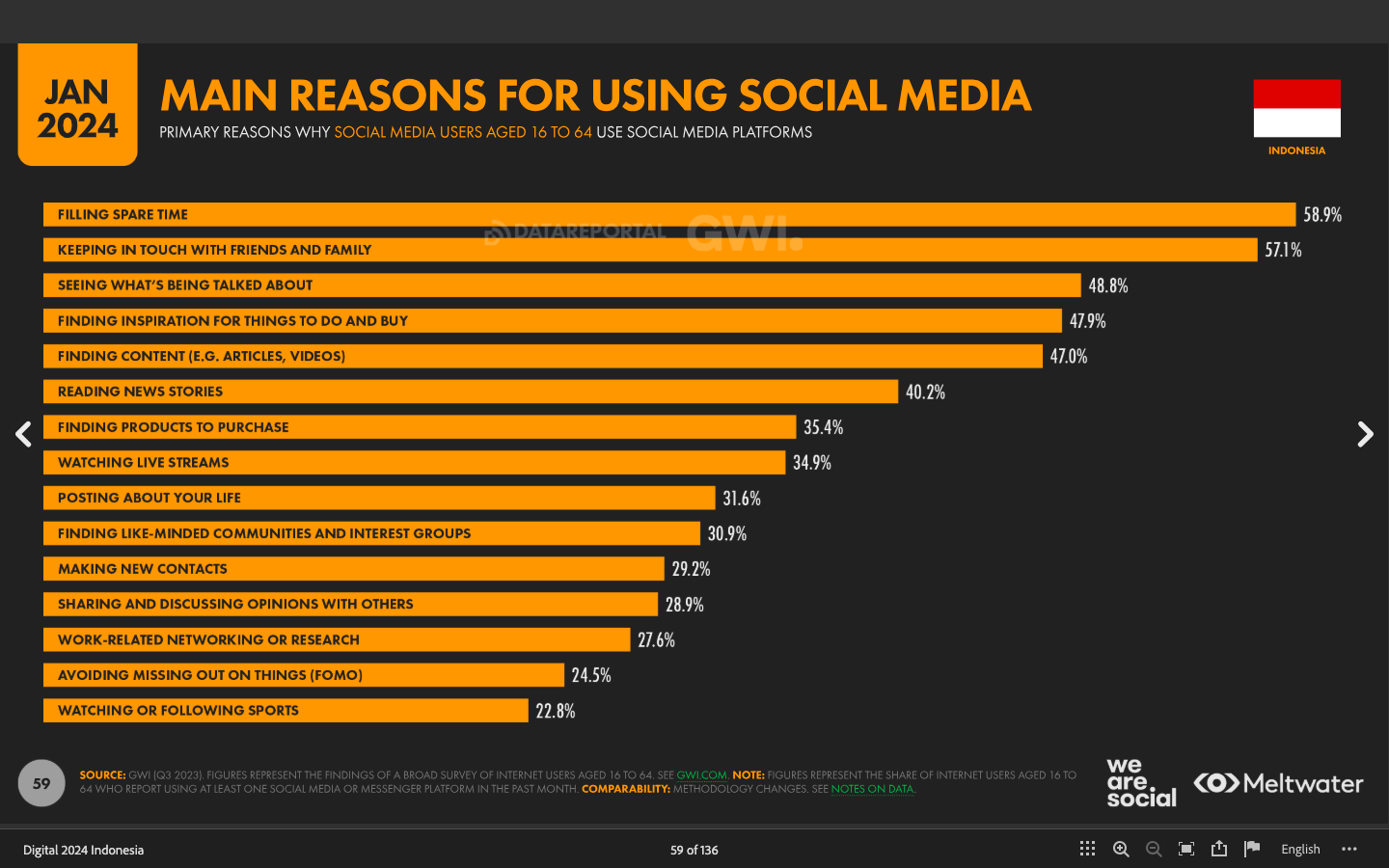

Data menunjukkan bahwa 58,9% pengguna media sosial di Indonesia menggunakannya untuk “filling spare time” (mengisi waktu luang), sementara 57,1% untuk “keeping in touch with friends and family” (menjaga kontak dengan teman dan keluarga). Yang menarik, 47% pengguna mencari konten seperti artikel dan video, sedangkan 40,2% membaca berita.

Pola ini mengindikasikan bahwa meski hiburan masih menjadi motivasi dominan, terdapat porsi signifikan yang menggunakan media sosial untuk tujuan informatif dan edukatif. Fakta bahwa 30,9% pengguna mencari komunitas dengan minat serupa menunjukkan potensi besar untuk pembelajaran kolaboratif dan peer-learning—komponen penting dalam paradigma pendidikan kontemporer.

Apakah kita telah mengoptimalkan potensi ini untuk mencapai target SDG 4.7 tentang pengetahuan dan keterampilan untuk pembangunan berkelanjutan? Atau kita masih terjebak dalam dikotomi artifisial antara “media sosial untuk hiburan” versus “platform resmi untuk pendidikan”?

Media Sosial sebagai Ecosystem Pembelajaran: Menuju SDGs melalui Digital Engagement

SDG 4 menekankan pendidikan berkualitas yang inklusif dan merata bagi semua. Dalam konteks Indonesia dengan tantangan geografis dan infrastruktural yang kompleks, media sosial dapat menjadi jembatan penting menuju pemerataan akses pendidikan.

Data menunjukkan bahwa 27,6% pengguna memanfaatkan media sosial untuk “work-related networking or research”. Angka ini mungkin tampak moderat, namun menyiratkan potensi besar untuk pengembangan kapasitas profesional dan vocational learning—selaras dengan target SDG 4.4 tentang peningkatan keterampilan teknis dan kejuruan.

Berdasarkan pengamatan saya, beberapa inisiatif edukasi yang berhasil di Indonesia justru memanfaatkan karakteristik platform yang populer:

- Microlearning melalui thread Twitter/X

- Tutorial singkat di Instagram dan TikTok

- Grup diskusi tematik di WhatsApp dan Telegram

- Webinar dan kursus daring melalui Facebook Live

Pendekatan semacam ini menerapkan prinsip “jemput bola”—membawa pendidikan ke platform yang sudah digunakan target audience, alih-alih mengharapkan mereka beralih ke platform khusus pendidikan.

Tantangan dan Dilema: Antara Hiburan dan Literasi Digital

Meski memiliki potensi besar, pemanfaatan media sosial untuk pendidikan menghadapi tantangan signifikan. Durasi penggunaan TikTok yang mencapai 38 jam lebih per bulan menimbulkan pertanyaan tentang keseimbangan dan kualitas engagement. Apakah waktu tersebut dihabiskan untuk konten yang bermanfaat, atau sekadar scrolling tanpa tujuan?

Tantangan ini diperumit oleh fakta bahwa hanya 28,9% pengguna yang menggunakan media sosial untuk “sharing and discussing opinions with others”—aktivitas yang mendorong pemikiran kritis dan reflektif. Padahal, pemikiran kritis merupakan komponen esensial dari SDG 4.7 tentang pembangunan berkelanjutan dan warga global.

Seperti pisau bermata dua, media sosial dapat menjadi wahana pembelajaran transformatif maupun jebakan echo chamber yang memperkuat bias dan miskonsepsi. Menyeimbangkan aspek hiburan dan edukatif menjadi krusial untuk mengoptimalkan dampak positifnya.

Strategi Intervensi: Mengubah Konsumen menjadi Pembelajar Aktif

Untuk menyelaraskan pola penggunaan media sosial dengan SDGs, diperlukan pendekatan multidimensi yang melibatkan berbagai pemangku kepentingan:

- Konten Edukatif yang Entertaining: Mengintegrasikan pesan edukatif dalam format yang menarik dan sesuai karakteristik platform (contoh: edutainment di TikTok, infografis di Instagram)

- Digital Citizenship Education: Mengembangkan program literasi digital yang komprehensif, berfokus pada kemampuan evaluasi kritis terhadap informasi online

- Kolaborasi Strategis: Membangun kemitraan antara institusi pendidikan, creator konten, dan platform media sosial untuk mengamplifikasi konten berkualitas

- Monetisasi Konten Edukatif: Menciptakan insentif ekonomi bagi creator yang memproduksi konten pendidikan berkualitas

- Regulasi dan Kebijakan: Mengembangkan framework regulasi yang mendorong platform untuk memprioritaskan konten edukatif dalam algoritma mereka

Menariknya, 47,9% pengguna mencari inspirasi untuk hal-hal yang bisa dilakukan dan dibeli. Ini menunjukkan keterbukaan terhadap ide-ide baru—fondasi penting untuk pembelajaran seumur hidup yang menjadi esensi SDG 4.

Merajut Masa Depan Pendidikan dari Benang Digital

Data penggunaan media sosial di Indonesia menawarkan narasi yang kompleks tetapi penuh harapan. Di satu sisi, terdapat kecenderungan konsumsi pasif dan orientasi hiburan. Di sisi lain, terdapat potensi besar untuk transformasi pendidikan melalui platform yang telah diadopsi secara luas.

Seperti ungkapan “bertemu ruas dengan buku”, pertemuan antara tren penggunaan media sosial dengan kebutuhan pendidikan berkelanjutan dapat menciptakan sinergi yang transformatif. Tantangannya adalah mengubah paradigma yang memisahkan “scrolling” dari “schooling” menjadi model yang mengintegrasikan keduanya secara harmonis.

Jika berhasil, Indonesia tidak hanya akan mencapai target-target SDG 4, tetapi juga menciptakan model inovatif pendidikan digital yang relevan dengan kebutuhan Generasi Z dan generasi mendatang—generasi yang tidak mengenal dunia tanpa internet dan media sosial.

Referensi

DataReportal. (2024). Digital 2024: Indonesia. Diakses dari https://datareportal.com/reports/digital-2024-indonesia